Windfall Profits Tax.

As oil company profits increase with the price of fuel, the call for a windfall profits tax resurfaces. The last time we had such a tax yielded unsatisfactory results which is why it did not last. There is no reason to believe anything has changed in that respect. To understand the gas price situation there are aspects that have a great effect on the price at the pump that have nothing to do with the oil companies. In fact the very entity that wants to punish oil companies is more culpable for high pump prices that the companies they vilify.

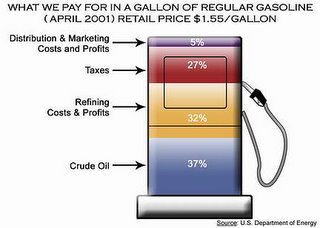

First let's look at how much of the price of gas is oil company profit.

Oil company profits are huge because the companies are huge, the product of oil firm mergers in the last few years to be more competitive globally, he said. Exxon Mobil's profit, including $10.7 billion in the fourth quarter, was on average slightly more than 10 cents on a dollar of gas, he said, while other oil companies that have reported end-of-year profits already were closer to 9 cents.

Now look at what the federal and state government's profit is on a gallon of gas.

The U.S. federal gasoline tax as of 2005 was 18.4¢/gal (4.86¢/L), and the gasoline taxes in the various states range from 10 cents to 33 cents, with an average about 22 cents per U.S. gallon (5.8¢/L).

according to a study paid for by the U.S. Chamber of Commerce. State gasoline taxes range from 7.5 cents per gallon in Georgia to 45.7 cents in New York. Only Connecticut, Florida, Kentucky, Nebraska, North Carolina and West Virginia have gasoline taxes that vary with the price of fuel or inflation. Wisconsin will no longer index its gas tax after this year's annual adjustment

emphasis mine

So who has the ability to adjust the price of gasoline down? The profits that oil companies make are taxable income so on top of the tax government charges at the pump it also gets a piece of the action from the oil companies. Still politicians are calling for more tax on the oil companies. in the face of all this many of the states are carrying a budget surplus.

Just a few are listed below FYI.

Maryland

It's an election year, and Maryland is running a budget surplus of more than $1 billion.

Utah

a projected surplus of $1.6 billion in the current fiscal cycle ending June 30, 2007.

Connecticut

Connecticut's state budget surplus projection increased sharply to $511.8 million from $327 million in the past month, Gov. M. Jodi Rell announced Friday.

Florida

of the estimated $2.5 billion in surplus revenue.

Wisconsin

Wisconsin will reap about $93 million more than expected in tax revenue this budget cycle, the Legislative Fiscal Bureau just announced.

Virginia

the Old Dominion is enjoying a billion-dollar "surplus" even as some in the General Assembly urge higher taxes.

Looking at these numbers one has to wonder, "Who has the windfall here?" The politicians rant over the evil oil companies yet are not willing to give relief to the consumer by lowering the tax they take on fuel. Even worse some states such as Virginia want to increase the tax. Envy is a poor foundation for public policy. The politicians are duplicitous at best to demagogue an issue in which they are part of the problem.

Basil's

BlogHop.com

BlogHop.com

1 Comments:

|Ah well, if we're gonna tax them in a good year we oughta at least be rigorous enough in our logic to underwrite them in a bad year.

"Course most Oil companies margins are less than the Ney York Times and *way* less than Microsofts.... its just that they deal in vastly larger quantities and so muuuuuuuch bigger numbers. Most profit is made on overeas operations anyhow, so just what part of the MultiNationals are ya gonna tax and how do you think those businesws units will react?

Can you say Hasta La Vista?

Post a Comment

<< Home